CFTC chair insists Ether is a commodity, not security as claimed by SEC chairman

Noting that ether-based products have been “listed on CFTC exchanges for quite some time”

By Staff

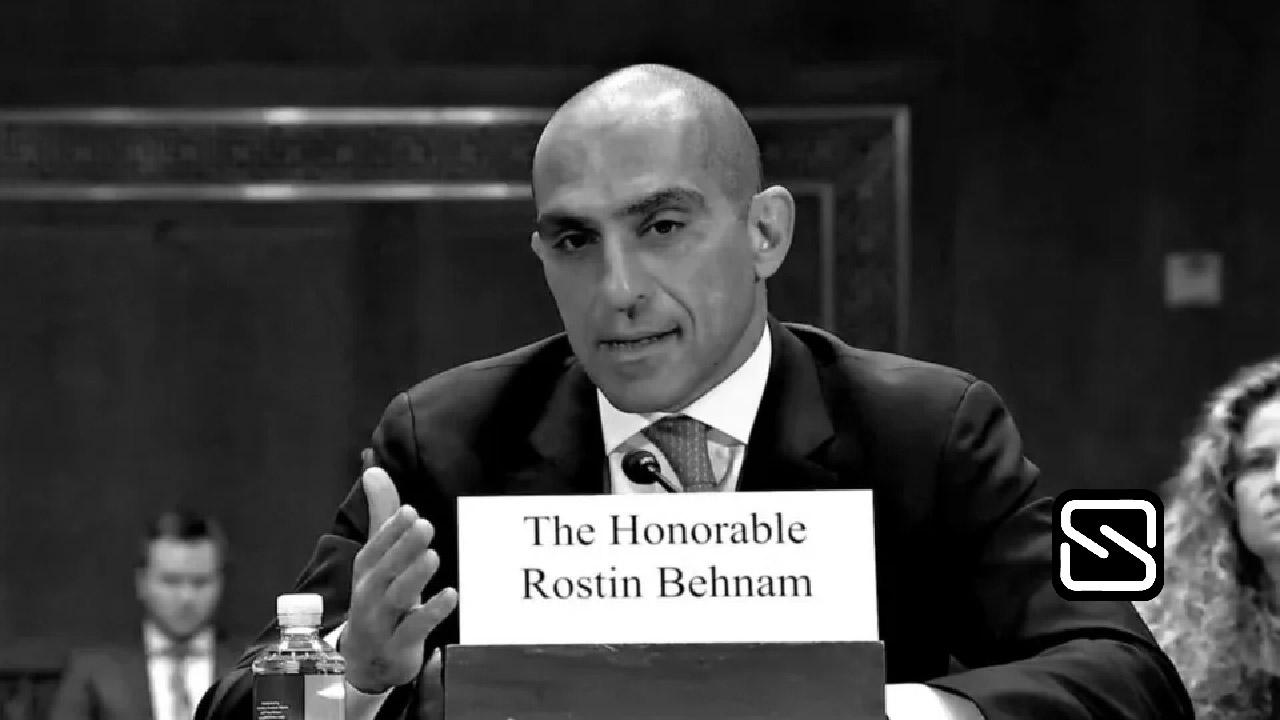

At a hearing before the Senate Committee on Agriculture, Nutrition, and Forestry on Wednesday, the chairman of the Commodity Futures Trading Commission (CFTC), Rostin Behnam, addressed the assertion made by the chairman of the Securities and Exchange Commission (SEC), Gary Gensler, that all crypto tokens aside from bitcoin are securities.

Senator Kirsten Gillibrand (D-NY) questioned Behnam about the implications of Chairman Gensler’s recent assertion that all digital assets other than bitcoin are securities for the designated contract markets (DCMs) that currently provide futures or swaps on ether. DCMs are exchanges that function under the CFTC’s regulatory control.

“It would obviously raise questions about the legality of those DCMs, designated contract markets, listing these digital assets that are purported to be securities,” the CFTC chairman replied, reiterating, “I’ve made the argument that ether is a commodity.”

Noting that ether-based products have been “listed on CFTC exchanges for quite some time,” Behnam said: “For that reason, it creates a very direct jurisdictional hook for us to police obviously the derivatives market but also the underlying market as well.”

He further detailed: “The process for which an exchange or DCM will list a contract is very clear under our law. They could seek approval from the Commission [CFTC] or they could self-certify a product. That self-certification process is one that shifts the responsibility to both the CFTC and the market participant.”

The CFTC chief proceeded to explain why he strongly believes that ether is a commodity. “I would say serious and deep legal analysis goes into the thought process before a product is self-certified, so there’s no doubt in my mind and having known this and been at the Commission when ether futures were listed that both the exchange and the Commission thought very deeply and thoughtfully about ‘what is the product?’ and ‘does it fall within the commodity regime or the security regime?’” He stressed:

We would not have allowed the product, in this case, the ether futures product, to be listed on a CFTC exchange if we did not feel strongly that it was a commodity asset.

“Because we have litigation risk, we have agency credibility risk if we do something like that without serious legal defense or defenses to sort of support our argument that the asset is a commodity,” Behnam concluded.