FlexID receives funding from Algorand to provide self-sovereign IDs to Africa’s unbanked

Zimbabwean startup, FlexID has received funding to promote financial inclusion for people unable to access banking services with a blockchain-based identity system.

By Staff

African countries have made great strides in promoting financial inclusion over the past decade, but it’s still early days. More than 60% of adults in sub-Saharan Africa are unbanked, according to World Bank estimates for 2021.

Zimbabwe’s FlexID is working towards the financial inclusion goal by developing a blockchain-based identity system for people who are unable to access banking services owing to a lack of identification documents. Algorand, a blockchain technology established by Turing Award-winning cryptographer Silvio Mical, has funded FlexID’s initiative.

While there have been several highs and lows of bitcoin valuations recently that have gotten a lot of attention in the blockchain world, startups like FlexID are reminding us that technology can serve a variety of other purposes, including providing secure identity records.

In Zimbabwe, only 30% of the adult population had access to any financial services as of 2014. The number of bank accounts in the country was 1.5 million in 2016. FlexID is looking forward to bridging such gaps.

There’s a general conception that increasing access to financial services in a country will lead to improvement in people’s economic welfare. We have seen this already working in Zimbabwe after the Zimbabwean Government introduced a financial inclusion scheme from 2016 to 2020. The effort achieved some success: the percentage of the Zimbabwean adult population with access to financial services increased to 55% while the number of bank accounts rose to 8.5 million in 2020.

There is, however, still more work to be done in this area. When people have little or no faith in the financial system, are unaware that specific financial services that fit their needs exist, or lack official identity documents to access these services, achieving optimal financial inclusion can seem impossible.

Not only Zimbabwe but Africa and emerging markets as a whole are affected by these concerns. FlexID’s self-sovereign identification (SSI) platform is decentralized and allows users authority over their personal information, which is unusual in Africa, where other upstarts such as Smile Identity, YC-backed Identitypass, and Dojah provide centralized solutions.

FlexID plans to use the financing from Algorand to expand its decentralized identity network into emerging nations, where an estimated one billion individuals lack formal identification, according to the business. Victor Mapunga, a Zimbabwean entrepreneur, founded FlexID in 2018 as a response to his frustrations with the banking system.

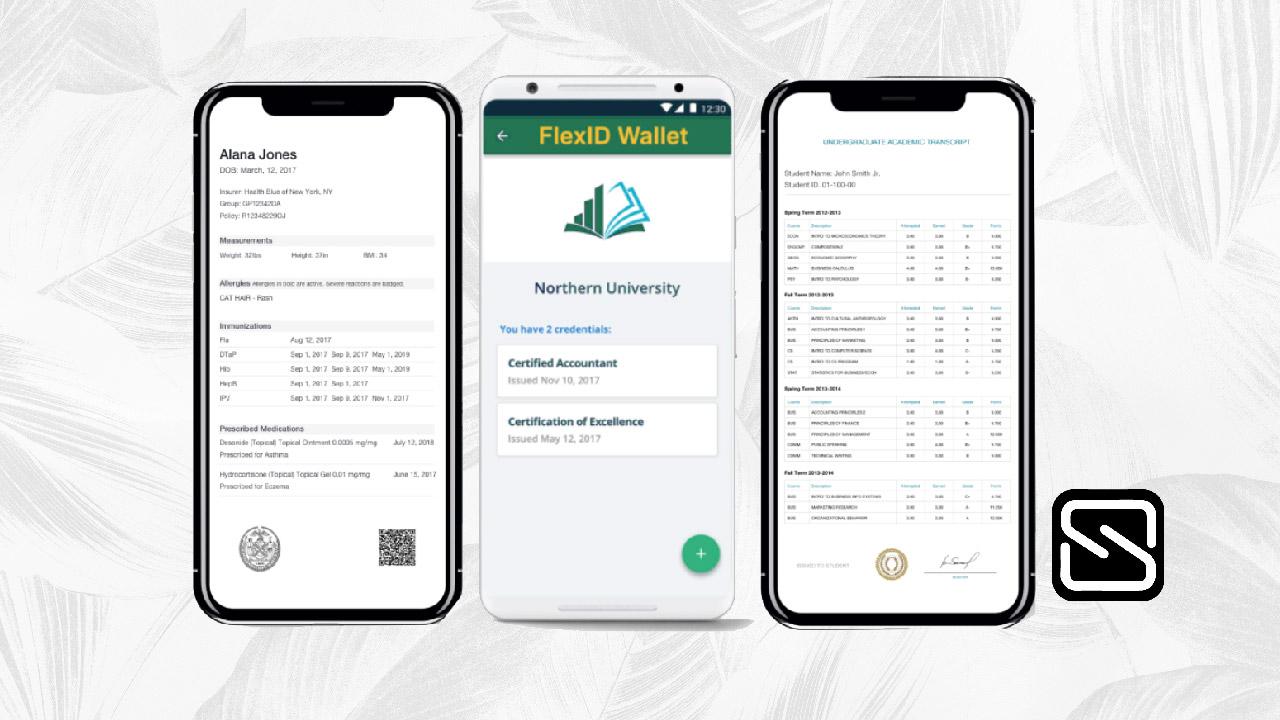

FlexID provides customers with a blockchain wallet in which their verifiable credentials are stored. Algorand, which promotes itself as a solution to the blockchain trilemma of security, scalability, and decentralization, does the verification on-chain. FlexID will also work with Algorand’s other decentralized apps (dApps).

Algorand’s investment in FlexID comes at a time when African blockchain firms are attracting significant funding. According to a recent estimate, nearly 40 African blockchain firms raised $127 million in 2021. This year has already seen some eye-popping investments, such as Mara’s $23 million seed round from Coinbase and FTX, two of the world’s largest cryptocurrency exchanges.

Despite the fact that FlexID provides services in the identification area, the overarching industry in which its solution and the majority of blockchain platforms fall is fintech. Companies like FlexID are using crypto to reduce people’s reliance on cash and transfer fees, lower the hurdles to opening an account with crypto wallets, and address the continent’s paperwork problem.